Stonewell Bookkeeping Things To Know Before You Get This

Wiki Article

Examine This Report on Stonewell Bookkeeping

Table of ContentsThe Buzz on Stonewell BookkeepingA Biased View of Stonewell BookkeepingAn Unbiased View of Stonewell BookkeepingNot known Incorrect Statements About Stonewell Bookkeeping Stonewell Bookkeeping - The Facts

Every company, from hand-crafted towel makers to game developers to dining establishment chains, earns and spends money. Bookkeepers aid you track all of it. What do they truly do? It's hard recognizing all the solution to this inquiry if you've been entirely concentrated on growing your company. You could not completely comprehend and even begin to fully appreciate what a bookkeeper does.The background of accounting dates back to the start of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants maintained documents on clay tablets to maintain accounts of deals in remote cities. It was composed of an everyday journal of every transaction in the chronological order.

Small companies may depend solely on an accountant initially, yet as they grow, having both experts on board becomes increasingly valuable. There are two main types of accounting: single-entry and double-entry bookkeeping. records one side of a monetary transaction, such as adding $100 to your cost account when you make a $100 purchase with your credit scores card.

Examine This Report about Stonewell Bookkeeping

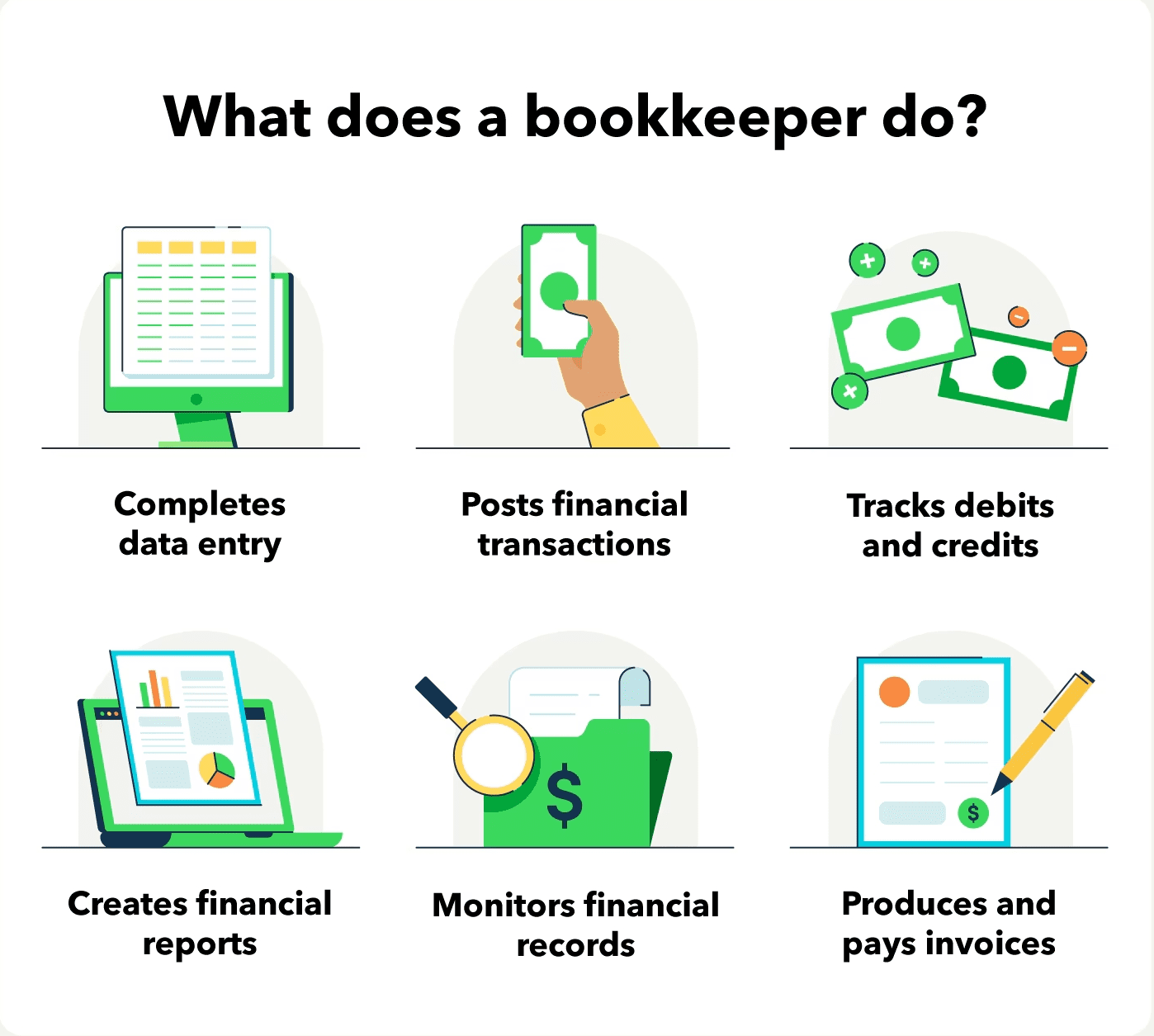

entails tape-recording economic transactions by hand or utilizing spreadsheets - small business bookkeeping services. While low-cost, it's time consuming and susceptible to errors. usages tools like Sage Cost Administration. These systems instantly sync with your credit scores card networks to provide you credit scores card purchase data in real-time, and immediately code all data around expenses including projects, GL codes, areas, and classifications.They make certain that all documents complies with tax obligation regulations and guidelines. They keep track of money circulation and consistently produce financial records that help crucial decision-makers in a company to press the company ahead. Furthermore, some accountants additionally assist in maximizing pay-roll and billing generation for an organization. A successful bookkeeper needs the complying with abilities: Precision is type in economic recordkeeping.

They typically start with a macro perspective, such as a balance sheet or an earnings and loss declaration, and then drill into the information. Bookkeepers guarantee that supplier and client records are always up to date, even as individuals and organizations change. They may also need to collaborate with various other divisions to ensure that everyone is utilizing the same information.

Facts About Stonewell Bookkeeping Revealed

Bookkeepers swiftly process incoming AP deals on schedule and ensure they are well-documented and easy to audit. Getting in bills right into the accounting system allows for exact preparation and decision-making. Bookkeepers swiftly develop and send invoices that are easy to track and replicate. This aids companies receive payments quicker and boost money flow.Include interior auditors and compare their counts with the videotaped worths. Accountants can function as freelancers or in-house staff members, and their compensation differs depending on the nature of their employment.

Consultants often bill by the hour however might offer flat-rate bundles for particular tasks., the typical bookkeeper income in the United States is. Remember that salaries can differ depending on experience, education, location, and industry.

Consultants often bill by the hour however might offer flat-rate bundles for particular tasks., the typical bookkeeper income in the United States is. Remember that salaries can differ depending on experience, education, location, and industry.The 9-Second Trick For Stonewell Bookkeeping

Several of the most common paperwork that organizations have to send to the federal government includesTransaction info Financial statementsTax compliance reportsCash circulation reportsIf your accounting is up to day all year, you can avoid a heap of stress throughout tax season. White Label Bookkeeping. Perseverance and interest to detail are essential to better accounting

Seasonality belongs of any type of task on the planet. For bookkeepers, seasonality implies durations when repayments come flying in with the roof covering, where having impressive job can become a severe blocker. It comes to be crucial to expect these moments ahead of time and to finish any backlog prior to the pressure duration hits.

Some Known Questions About Stonewell Bookkeeping.

Avoiding this will reduce the risk of causing an internal revenue service audit as it gives an exact depiction of your funds. Some common to keep your personal and service financial resources different areUsing an organization credit report card for all your service expensesHaving different monitoring accountsKeeping receipts for individual and overhead different Visualize a world where your accounting is done for you.Staff members can respond to this message with a photo of the invoice, and it will instantly match it for discover here you! Sage Cost Management supplies very adjustable two-way combinations with copyright Online, copyright Desktop, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These assimilations are self-serve and need no coding. It can instantly import information such as workers, projects, groups, GL codes, departments, job codes, expense codes, taxes, and more, while exporting expenditures as costs, journal entries, or credit score card fees in real-time.

Think about the adhering to tips: An accountant that has worked with organizations in your sector will certainly much better understand your certain demands. Ask for recommendations or check on the internet evaluations to guarantee you're employing a person trusted.

Report this wiki page